Uncovering Embezzlement: Financial Fraud Exposed

The Dark Side of Trust: Embezzlement Tactics Revealed

Embezzlement, a deceptive financial crime that erodes trust and integrity, operates within the shadows of legitimate transactions. Perpetrators, often trusted insiders, manipulate financial systems and processes for personal gain, leaving behind a trail of deceit and financial ruin.

Embezzlement Schemes: Anatomy of White-Collar Crime

Embezzlement schemes come in various forms, ranging from misappropriation of funds to falsification of records. Common tactics include shell companies, phantom employees, and fraudulent expense claims. These schemes exploit vulnerabilities in financial controls and oversight, making detection challenging.

Combating Embezzlement: Strategies for Detection and Prevention

Effective detection and prevention strategies are crucial in combating embezzlement. Implementing robust internal controls, conducting regular audits, and promoting a culture of transparency and accountability can deter potential perpetrators and mitigate risks of financial fraud.

Embezzlement in the Corporate World: Risks and Ramifications

Embezzlement poses significant risks to corporations, including financial losses, damaged reputation, and legal consequences. The ramifications extend beyond monetary impact to eroding investor confidence and disrupting business operations, highlighting the need for proactive risk management.

Embezzlement Red Flags: Recognizing Warning Signs Early

Early detection of embezzlement red flags is paramount in preventing extensive financial damage. Warning signs may include unexplained discrepancies in financial statements, sudden lifestyle changes by employees, and reluctance to provide access to financial records during audits.

Unraveling Embezzlement: Understanding Motivations and Methods

Understanding the motivations behind embezzlement is essential for addressing root causes. Common motivations include financial pressures, greed, and perceived opportunities due to lax controls. Perpetrators often employ sophisticated methods to conceal their activities, necessitating thorough investigations.

Exposing Embezzlement Scandals: Lessons in Corporate Governance

Embezzlement scandals serve as stark reminders of the importance of robust corporate governance practices. Effective oversight, ethical leadership, and transparent financial reporting are critical in safeguarding against financial misconduct and preserving stakeholder trust.

The Cost of Embezzlement: Impact on Businesses and Investors

The financial and reputational costs of embezzlement can be staggering for businesses and investors alike. Recovery efforts, legal fees, and damage control measures can drain resources and hinder business growth, underscoring the need for preventive measures.

Embezzlement vs. Fraud: Distinguishing Between Financial Crimes

While embezzlement and fraud are both forms of financial misconduct, they differ in scope and intent. Embezzlement involves the misappropriation of entrusted funds or assets by individuals within an organization, whereas fraud encompasses a broader range of deceptive practices targeting external entities.

Embezzlement Risk Management: Safeguarding Assets and Integrity

Effective embezzlement risk management involves a comprehensive approach to safeguarding assets and preserving organizational integrity. This includes implementing internal controls, conducting regular risk assessments, and fostering a culture of ethical conduct and accountability among employees.

Consequences of Embezzlement: Legal, Financial, and Reputational

The consequences of embezzlement extend beyond financial losses to encompass legal liabilities, regulatory scrutiny, and reputational damage. Civil and criminal penalties, lawsuits from affected parties, and adverse publicity can have lasting impacts on individuals and organizations involved in embezzlement schemes.

Embezzlement in Nonprofit Organizations: Challenges and Solutions

Nonprofit organizations are not immune to embezzlement risks, as evidenced by high-profile cases in the sector. Implementing tailored solutions, such as enhanced oversight, whistleblower protection, and transparent financial reporting, can help mitigate embezzlement risks and preserve donor trust.

Preventing Embezzlement in Small Businesses: Best Practices

Small businesses are particularly vulnerable to embezzlement due to limited resources and oversight capabilities. Adopting best practices, such as segregation of duties, regular reconciliations, and employee background checks, can strengthen internal controls and deter fraudulent activities.

Detecting Embezzlement: Tools and Techniques for Investigation

Detecting embezzlement requires leveraging specialized tools and techniques for thorough investigations. Forensic accounting, data analytics, and digital forensic techniques can uncover hidden patterns, trace financial transactions, and gather evidence to support legal proceedings.

Embezzlement in Government Agencies: Transparency and Oversight

Government agencies face unique challenges in combating embezzlement, given the complexity of public funds and diverse stakeholder interests. Emphasizing transparency, accountability, and robust oversight mechanisms is crucial in preventing and detecting embezzlement within government entities.

Unethical Practices Unveiled: The Psychology of Embezzlement

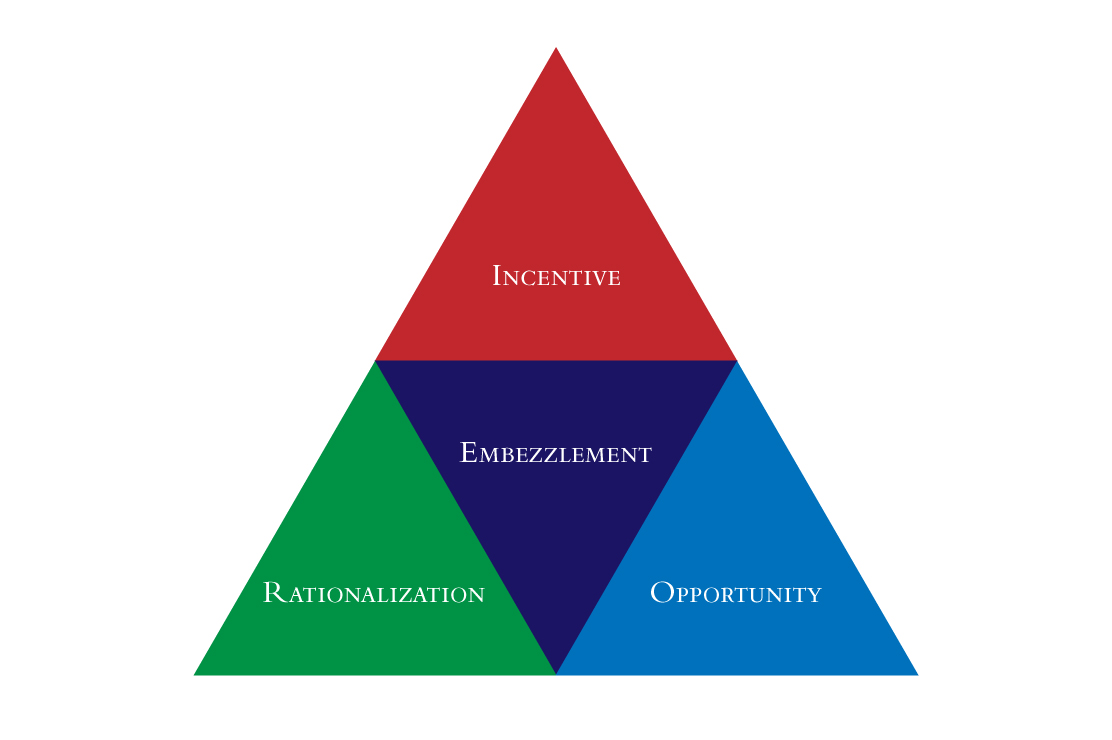

Exploring the psychology of embezzlement sheds light on the underlying motivations and rationalizations of perpetrators. Psychological factors such as rationalization, opportunity, and perceived grievances can contribute to unethical behaviors, highlighting the importance of addressing psychological drivers in preventive measures.

Embezzlement and Insider Threats: Vulnerabilities in Organizations

Embezzlement often stems from insider threats posed by employees, contractors, or trusted partners with access to sensitive information and assets. Identifying and mitigating insider threats through employee training, access controls, and behavioral monitoring can reduce embezzlement risks.

Embezzlement Laws: Understanding Regulations and Compliance

Embezzlement laws vary by jurisdiction, encompassing criminal statutes, civil liabilities, and regulatory requirements. Understanding legal frameworks, compliance obligations, and reporting obligations is essential for organizations to navigate embezzlement risks and ensure adherence to applicable laws.

Embezzlement Risk Assessment: Evaluating Vulnerabilities and Controls

Conducting embezzlement risk assessments helps organizations identify vulnerabilities, assess control effectiveness, and prioritize risk mitigation strategies. Risk assessment methodologies, such as scenario analysis, control self-assessments, and historical data analysis, can inform proactive risk management initiatives.

Embezzlement and Cybercrime: Digital Threats to Financial Security

The convergence of embezzlement and cybercrime poses significant challenges to financial security. Cyber-enabled embezzlement tactics, such as phishing scams, ransomware attacks, and data breaches, highlight the need for robust cybersecurity measures and incident response capabilities.

Embezzlement Impact on Stakeholders: Restoring Trust and Accountability

Embezzlement erodes stakeholder trust and accountability, necessitating efforts to restore confidence and transparency. Engaging stakeholders, implementing restitution measures, and enhancing communication can demonstrate commitment to addressing embezzlement impacts and rebuilding relationships.

Embezzlement Cases: Notable Examples and Lessons Learned

Studying notable embezzlement cases provides valuable lessons in identifying risk factors, improving detection methods, and implementing preventive measures. Case analyses can inform organizational strategies, regulatory reforms, and industry best practices for combating embezzlement.

Embezzlement Investigations: Steps to Uncovering Financial Misconduct

Conducting thorough embezzlement investigations requires adherence to established protocols, legal considerations, and forensic methodologies. Gathering evidence, interviewing witnesses, and collaborating with law enforcement agencies are essential steps in uncovering financial misconduct and holding perpetrators accountable.

Embezzlement in Financial Institutions: Strengthening Internal Controls

Financial institutions face inherent embezzlement risks due to the nature of their operations and access to sensitive financial assets. Strengthening internal controls, implementing fraud detection technologies, and enhancing employee training can bolster defenses against embezzlement schemes.

**Embezz Read more about Embezzlement