The Dark Side of Trust Embezzlement Tactics Revealed

Uncovering Embezzlement: Financial Fraud Exposed

The Dark Side of Trust: Embezzlement Tactics Revealed

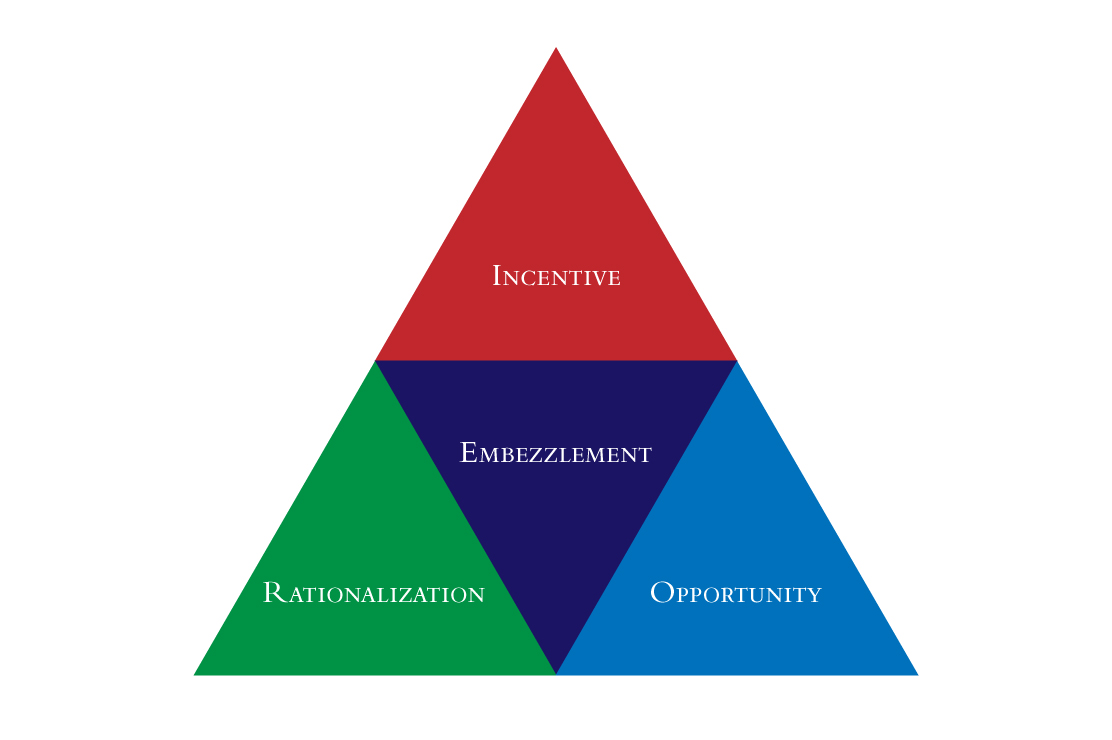

Embezzlement, a deceptive financial crime that erodes trust and integrity, operates within the shadows of legitimate transactions. Perpetrators, often trusted insiders, manipulate financial systems and processes for personal gain, leaving behind a trail of deceit and financial ruin.

Embezzlement Schemes: Anatomy of White-Collar Crime

Embezzlement schemes come in various forms, ranging from misappropriation of funds to falsification of records. Common tactics include shell companies, phantom employees, and fraudulent expense claims. These schemes exploit vulnerabilities in financial controls and oversight, making detection challenging.

Combating Embezzlement: Strategies for Detection and Prevention

Effective detection and prevention strategies are crucial in combating embezzlement. Implementing robust internal controls, conducting regular audits, and promoting a culture of transparency and accountability can deter potential perpetrators and mitigate risks of financial fraud.

Embezzlement in the Corporate World: Risks and Ramifications

Embezzlement poses significant risks to corporations, including financial losses, damaged reputation, and legal consequences. The ramifications extend beyond monetary impact to eroding investor confidence and disrupting business operations, highlighting the need for proactive risk management.

Embezzlement Red Flags: Recognizing Warning Signs Early

Early detection of embezzlement red flags is paramount in preventing extensive financial damage.