Understanding Pyramid Schemes A Comprehensive Guide

Unveiling the Truth: Pyramid Schemes Exposed

Understanding the Pyramid Scheme Phenomenon

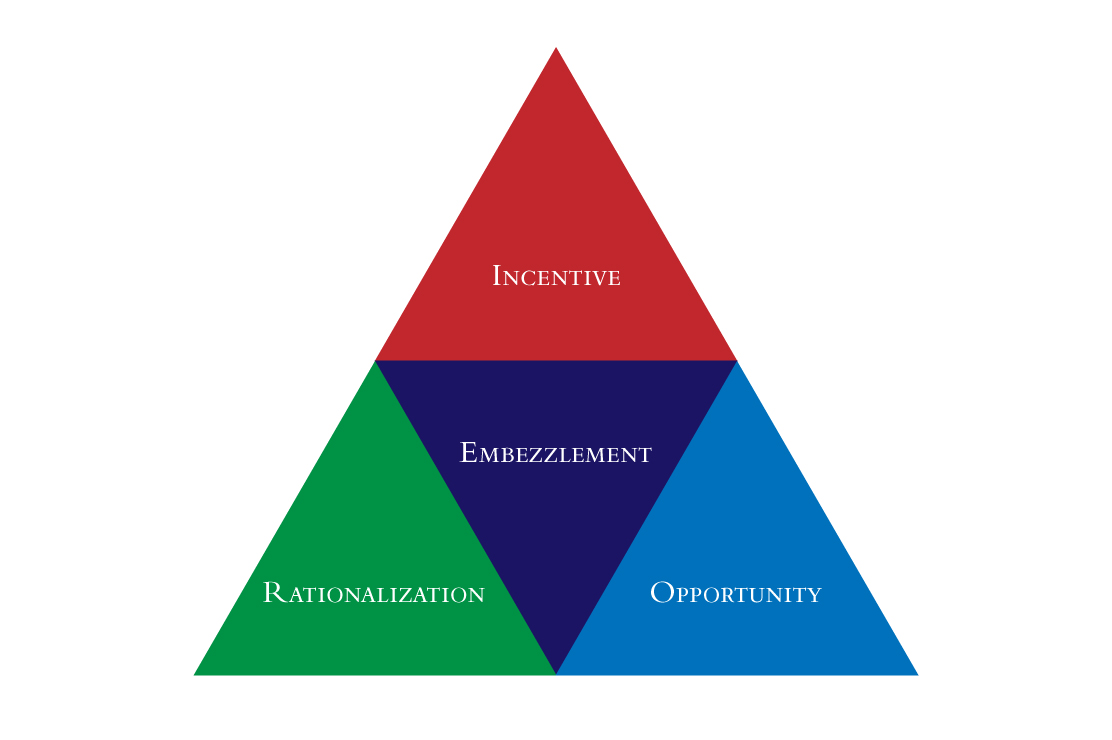

Pyramid schemes have been a persistent issue in the financial world, luring unsuspecting individuals with promises of quick wealth and easy money. However, beneath the surface lies a complex web of deception and financial exploitation. Understanding the fundamentals of pyramid schemes is crucial to protect oneself from falling victim to these fraudulent practices.

The Structure of a Pyramid Scheme

At the core of every pyramid scheme is a hierarchical structure where participants are encouraged to recruit others into the scheme in exchange for monetary rewards. New recruits are often required to make an initial investment, which is then funneled upwards to those at the top of the pyramid. As the scheme grows, the base widens, but only those at the pinnacle reap substantial profits, leaving many at the bottom empty-handed.

Red Flags and Warning Signs

One of the key indicators of a pyramid scheme is the heavy emphasis on recruitment rather than the sale of actual products or services. Participants are often incentivized to recruit others with the promise of high returns, creating a never-ending cycle of recruitment without tangible value creation. Additionally, pyramid schemes may use misleading marketing